Case Study

The following is an example of a company that did not have their real estate strategy aligned with their business plans. For this study, we’ll refer to this national healthcare service company as “NHSC”. We’ll review the challenges, strategy, budget, and lessons learned.

Background

NHSC has offices, comprised of 12,000 – 20,000 square feet in many of the major metropolitan cities across the country. NHSC is an expanding organization, however, not at the pace that the major tech companies are expanding. NHSC had a lease expiring in San Francisco June 30, 2019. In December 2018, NHCS gave direction to their facilities manager to start looking for new office space in San Francisco with the uneducated assumption that six months was ample time to relocate the offices. The building owner of the space NHSC had leased for the past five years had leased the space to an existing expanding tenant within the building, effective July 1, 2019; NHSC had to vacate by June 30th.

The facilities manager hired a broker to help conduct the survey of available space and to guide them through the office leasing process for new space. The broker was aware of the market conditions and realized their client was not in a favorable position due to the short period of time for site selection, prepare offers to lease, negotiate letters of intent, negotiate leases, program and design the space for efficient workplace environment, employee comfort and retention and representation of the corporate image for clients and guests.

Had the facilities manager been more experienced, he would’ve requested an introduction to local designers, contractors and furniture consultants during the site selection process so that the team could be programming, designing and budgeting the new workplace while the lengthy lease negotiations occurred. Instead, they waited until the lease was nearly ready for execution to engage the team.

The Timelines

Expedited site review and lease negotiations:

16-20 weeks

Expedited programming & design:

8-10 weeks

Construction documents & bidding:

6-8 weeks

Landlord review and approval:

1-2 weeks

Construction, commissioning and FF&E

14-20 weeks

Approximate time from start to move-in:

40-54 weeks (some overlapping)

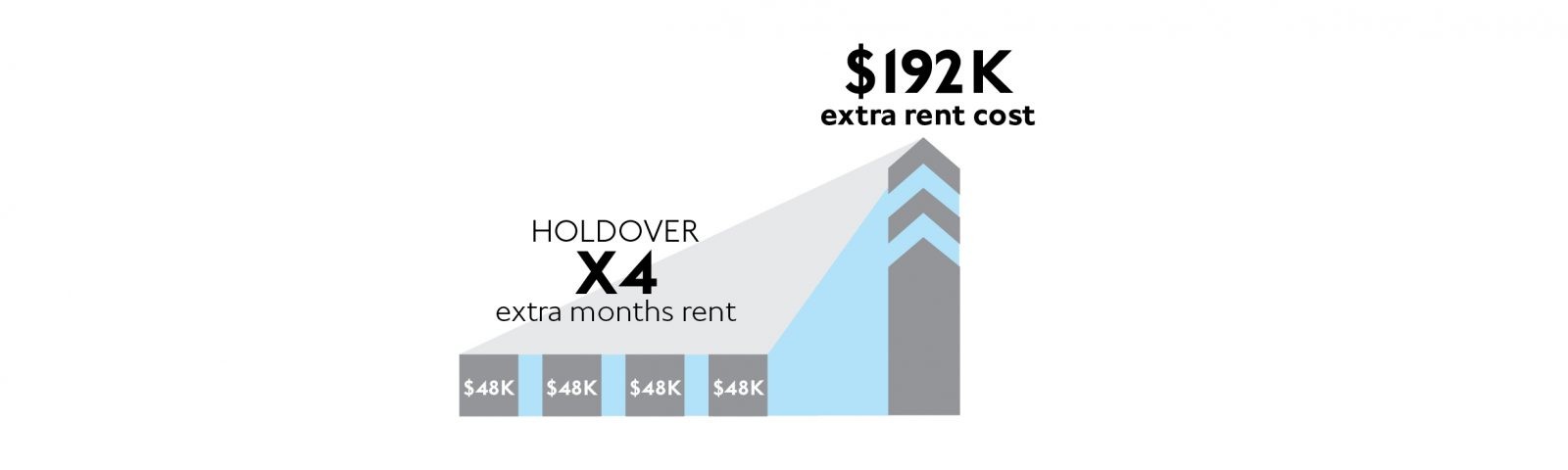

NHSC occupied the new space November 1, 2019, four months after they were supposed to vacate the premises and approximately eleven months after they began the process. This holdover, which is typical for most office leases, cost NHSC 200% of their current monthly rent each month they held over.

In this case, 12,000 SF at $48,000 monthly rent escalated to $96,000/month for four months, an extra rental cost of $192,000!

How the budget was exceeded

NHSC was at a disadvantage from the minute they directed the facilities manager to start the process. Without having the luxury of time on your side for site review, programming, designing to be sure the space fits right, and lease negotiations, the tenant lost all leverage in the marketplace. The landlord’s broker was aware of NHSC’s current lease situation, as most astute brokers are, and used that information to their advantage. They knew NHSC had limited options and were desperate to make a deal.

Further, the tenant waited so long to engage a designer/architect that they had to hire the landlord’s architect to design on their behalf. Again, they lost leverage in being able to shop and negotiate architectural services. If that’s not enough, the contractor was engaged with very little time to perform the normal preconstruction budgeting, scheduling, material selection, value engineering and subcontractor procurement. With the construction market as white hot as it was, all bidding leverage was lost and premiums were paid for construction costs, overtime to accelerate the schedule and expedited shipping costs for material delivery.

Final Analysis

Rent Premium Paid, 6 Year Lease:

$1,728,000

Holdover Penalty:

$ 192,000

Design, Construction, FF&E Premium:

$ 180,000

The hard costs for not aligning real estate and construction strategy with the business plan for this 12,000 square foot office tenant: $2.1M or $175/SF

Lessons Learned

Education

Leadership of NHSC, not having their fingers on the pulse of the real estate and construction markets, were not aware that they should have hired a real estate broker well before a year prior to their schedule lease expiration.

Prioritization

Developing a Sourcing Strategy such that the workplace design, engineering, construction and FF&E consultants are engaged in a timely manager to maximize leverage in the marketplace.

Preparation

Corporate leadership of NHSC was not educated on the markets, were ill-prepared on market conditions, and failed to have a strategy in place to minimize cost and schedule risk while maximizing market options and negotiating leverage.

Big Picture

With limited or no leverage, tenants are less likely to achieve necessary options that could have helped NHSC avoid many of these unnecessary cost overruns had they planned appropriately in both their prior lease negotiations and in the lease negotiations that they just completed.

How We can help

Hiring ProPath Advisors well ahead of lease expirations, planned expansions or contractions, mergers and acquisitions and internal operational changes, to mention the most common will likely save hundreds of thousands if not millions of dollars in occupancy costs. Setting a short, mid and long term real estate strategy is prudent business!

Let’s Start Something new

Contact Us!

Let us know what your challenges are, or what you may need some advice on. We’re looking forward to connecting with you!